Updated 9 months ago

GoodLeap solar loans: What you need to know

Written by

Ana Almerini

Find out what solar panels cost in your area

GoodLeap is a loan provider focusing specifically on lending money for sustainable home improvements, like adding home solar panels or the costs of switching to heat pumps.

People often won’t upgrade to sustainable alternatives because of the high upfront costs. GoodLeap offers solutions to that barrier by providing solar loan options for different budgets. GoodLeap LLC boasts itself as the #1 point-of-sale lender in America.

GoodLeap offers three solar loan options, with typical APRs between 5% and 9% and terms ranging from seven to 25 years.

Should you pay for your solar installation with GoodLeap? We reviewed the types of solar loans GoodLeap offers and what customers really think about the lender so that you can make the best choice for you.

GoodLeap solar loans at a glance:

-

GoodLeap is offered by many solar installers as a loan option, with standard installment loans, Flexpay loans, and Go Green Refi options.

-

GoodLeap loans usually have interest rates between 5% and 9% with dealer fees.

-

Reviews of GoodLeap are mixed, with most of the negative reviews more about the confusion about how a loan works than with GoodLeap itself.

-

GoodLeap is a viable loan option if a cash payment does not work for you.

How do GoodLeap loans work?

Generally, solar installers work with a few loan providers to give their customers options to choose from. Using a solar financing option offered by your installer takes a bit of the hassle out of shopping around for loans on your own.

GoodLeap is one of the most popular solar financing companies used by installers, according to our 2025 Solar Industry Survey results. If you’re looking into solar panels, you’ll probably encounter a quote or two with GoodLeap attached. You can get a GoodLeap loan for solar panels and batteries, which is convenient for homeowners seeking a hybrid solar system.

During the initial period of a GoodLeap loan, you make monthly payments and have time to apply for the federal solar tax credit. Then, you use the savings from the tax credit to pay down the loan to keep your payments about the same for the remainder of the loan term. If you don’t pay down 30%, your payment will likely increase.

fMany homeowners aren’t aware, but this is how most solar-specific loans are structured. Different loan offerings will have different setups, so don’t be surprised if how you pay looks a little different.

What solar loans does GoodLeap offer?

GoodLeap doesn’t publish specific details about its loan rate package on its website. But our experts can give you a general idea of what you might expect from a GoodLeap loan.

GoodLeap offers solar loans with terms between 7 and 25 years and can offer an APR rate as low as 1.99%. However, the interest rate will typically be closer to the 5% to 9% range, assuming the loan includes a dealer fee. Without a dealer fee, the APR will be higher.

Speaking of dealer fees, they can vary widely depending on your situation. Dealer fees could add anywhere from 20% to over 35% to your loan’s principal. If your installation costs $20,000, and you have a 35% dealer fee, your loan principal would be $27,000. Dealer fees help keep APRs low, and while the added money seems like a lot, it can sometimes save you in the long run.

But, the exact terms and how much you will pay depends on the type of loan you get. GoodLeap offers three types of solar loans: the standard installment, Flexpay loans, and Go Green Refi.

Standard installment

GoodLeap’s standard installment option is the most basic loan it offers. For the first 18 months of the standard loan, you make monthly payments to GoodLeap.

After 18 months, the loan will re-amortize. Your monthly payments could increase or stay the same, depending on how much you’ve paid off. Three likely scenarios can happen here:

If you paid down the loan by 30%: your monthly payments will remain about the same after re-amortizing.

If you didn’t pay down the loan by 30%: your monthly payments will increase after re-amoratizing.

If you pay down more than 30%: your monthly payments will be lower after re-amortizing.

This loan gives you 18 months to get the value of the 30% federal tax credit and then pay that 30% value to GoodLeap. Otherwise, your payments will increase.

Flexpay loans

If you need to spend as little as possible, a Flexpay loan could help you keep costs low. With Flexpay, you can choose how much you pay, allowing you to only make payments on the interest during an 18, 36, or 60-month period. After that period, the loan re-amortizes based on what you’ve already paid.

If you paid down 30% of your Flexpay loan, your payment will go up slightly for the remainder of your term. If you don’t make the 30% prepayment, you’ll see a significant increase in your payment.

After the loan is re-amortized, you can choose to prepay at any time. When you do this, you can either shorten the term of your loan or keep the same term and decrease your monthly payment!

Go Green Refi

GoodLeap also offers something called Go Green Refi that allows borrowers to refinance their mortgage to bundle their solar installation into their mortgage costs.

Bundling your loan into your mortgage can help you save money by potentially getting a lower rate and helping you save on taxes. Consult with your mortgage provider and a tax professional to make sure this move makes financial sense.

How to qualify for a GoodLeap loan?

Most homeowners in good financial standing will generally qualify for a GoodLeap loan. Your property must also meet a specific set of requirements to be eligible.

GoodLeap will only lend for projects installed on a residential, owner-occupied property. So if you want to secure solar financing for your investment property or a business, you’ll have to look elsewhere. You can use GoodLeap financing on a single-family home, townhouse, or condo, so long as you own the roof. Mobile homes are ineligible.

If you have a co-signer, they don’t need to live at the home, be on the title, or be related to you. GoodLeap will use the highest credit score between you and your co-signer.

Your credit score will impact your APR, dealer fee, and how much you can borrow. The following table outlines the credit score needed for different loan amounts:

Minimum credit score | Eligible loan amount |

|---|---|

600-649 | Up to $45,000 |

650-669 | Up to $50,000 |

670-699 | Up to $75,000 |

700+ | Up to $100,000 |

740+ | Up to $125,000 |

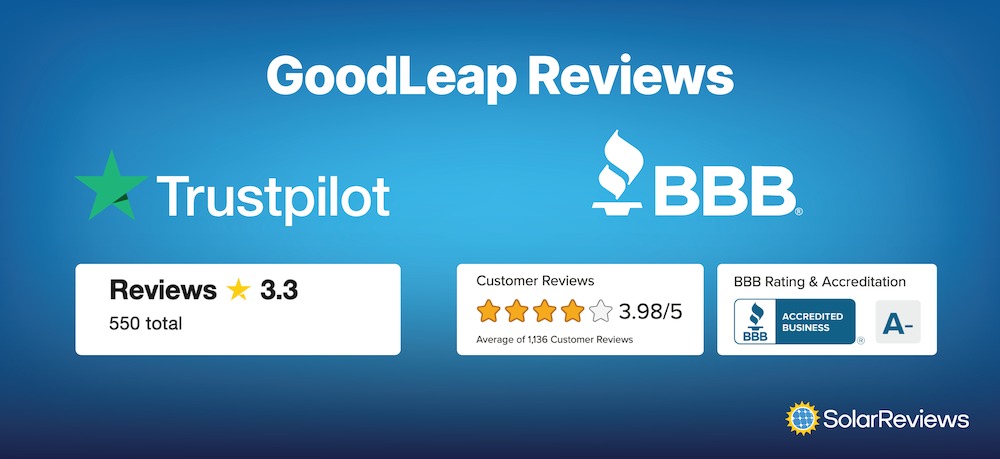

What is GoodLeap’s reputation?

As with most internet users in 2025, we jumped right to Reddit and the Better Business Bureau (BBB) to see what homeowners like you are talking about when it comes to GoodLeap.

The company enjoys positive feedback that when it works, it works well. You should be fine if your loan is straightforward and you pay it each month. Customer service seems generally okay, and review scores are more positive than many competitors.

Many negative reviews seem to be outside of GoodLeap’s control. One common theme seems to be that people don’t fully understand the deal they’re signing up for. Some complain of payments only going to interest and not to principal, but this is common with all different loan types, from student loans to mortgages. Others complain of issues ranging from their elderly parents signing loan deals they didn’t understand to being signed up for loans they did not agree to.

Sometimes, people run into issues if (in the rare chance) their solar system stops producing electricity, and they are stuck with an installer that went out of business or isn’t responsive. When this happens, the third-party loan still needs to be paid regardless of whether the solar system works. Triple-check the fine print before signing and see if you can negotiate a stop in payments if, for any reason, your solar system is not producing.

Overall, GoodLeap seems like a decent solar loan option, but it could provide more resources and be transparent so customers are fully informed. We highly doubt that will happen, so your best bet is to get a GoodLeap loan through a reliable solar installer that you feel thoroughly explains financing options and isn’t just trying to close the deal.

Is a GoodLeap loan right for you?

GoodLeap competes with other companies in the solar financing space, such as Mosaic, Sunlight Financial, Home Loan Investment Bank, and more!

It is hard to make a definitive judgment on GoodLeap loans because, most of the time, the best decision is the one that is right for your financial needs. Your solar installer will typically provide loan options for you, and if GoodLeap is an option for your sustainable home solutions, read through all of the fine print and make sure you understand any amortization schedules and the payments you can expect over the life of your loan.

Any type of loan can come with surprises, like if your panels stop working and you cannot stop your loan payment. Cash is always the best choice when adding a solar system, but if you do not have thousands of dollars ready, a GoodLeap loan can help you go solar.

If you want to find out if solar makes sense for you, visit our website to find local installers.

Ana is the Marketing & Communications Manager at SolarReviews, working within the solar industry since 2020. With a Master's in Climate and Society and professional experience in marketing, she helps communicate the value of solar to homeowners and build awareness of the SolarReviews brand. On weekends you can find her at the Jersey shore, reading a book from the ever-increasing stack on her side table, or eating food someone else cooked....

Learn more about Ana Almerini