Updated 11 months ago

Is Enerbank Best for Solar and Home Improvement Loans?

Written by

Cameron Bates

Find out what solar panels cost in your area

Chances are you’re here doing your research and trying to find out whether an Enerbank solar loan is the right option to finance a shiny new solar system.

The good news is we’ve got you covered, because we’ve completed a full sweep of all solar financing options that Enerbank has to offer. We also dive into customer experiences and see what they say about Enerbank.

So, let's find out whether or not an Enerbank solar loan is the right option for you.

Key takeaways

-

Enerbank USA is a FDIC-insured national consumer lender that specializes in providing home improvement loans.

-

Enerbank offers a range of different long and short-term solar financing options, with loans of up to $65,000.

-

With their fast and efficient online application process, Enerbank has become a leader in the home improvement and solar loan industry.

-

According to Enerbank reviews, borrowers have been disappointed with the company’s customer service and online payment options.

Overview of Enerbank

Enerbank USA is an FDIC-insured, national consumer lender founded in 2001 in Salt Lake City, Utah.

Enerbank specializes in offering loans for home improvement projects, such as residential solar panels and home upgrades. Through their streamlined loan approval and application process, they’ve become one of the biggest lenders in the industry.

Through their extensive experience in the industry, they have also developed a robust and expanding network of contractors and major retailers of home improvement projects. As such, there’s a good chance that one or more of the solar companies in your area offer Enerbank financing products.

Enerbank solar loan options

1. Same-As-Cash Loan

A Same-As-Cash Loan is a short-term lending option that offers borrowers flexibility, as well as the chance to utilize rebates and incentives, such as the 30% federal solar tax credit.

This loan option has no interest or monthly payments for a set period of up to 12 months.

At the end of the allocated no-interest period the loan must then be paid off in full. This means that the borrower will pay the same amount on the loan as they would’ve if they paid in cash.

Be careful though, if you’re unable to pay off the balance of the loan at the end of the up to 12 month period, then you may be faced with paying back interest and other possible charges.

2. Reduced Interest Loan

Enerbank’s Reduced Interest Loan is otherwise seen as an unsecured loan, which is a type of personal loan that requires no collateral. As no collateral is required from the borrower, an unsecured loan in most cases incurs a higher interest rate.

The Reduced Interest Loan will come with a fixed interest rate that usually ranges between 1.99% and 6.99%. This loan option requires a fixed monthly payment until the loan is paid in full.

3. Combo EZ Loan

The Combo EZ loan works by joining together two different loan types, namely, the aforementioned Same-As-Cash Loan and the Reduced Interest Loan.

The first part of the loan has the same terms as a Same-As-Cash Loan, and allows you to pay off your loan in full at the end of a no-interest period. This will allow you to utilize any credits and rebates.

The second part of the loan has the same terms as a Reduced Interest Loan. This means you’ll be able to make fixed monthly payments for a period of up to 12 years.

The benefit of a Combo Loan for solar installations is that you’re able to utilize rebates and incentives without being out-of-pocket. With the Same-As-Cash portion of your loan, once you’ve received your tax credits (during tax season), you’re able to repay that slice of the loan without incurring any interest.

4. Power Loan

The Power Loan is a single re-amortized loan option. It is one of Enerbank’s most popular loan options among both contractors and homeowners.

This loan was made specifically for homeowners looking to take advantage of the solar tax credit. It allows borrowers to use credits and incentives to pay off a portion of the principal and lower their monthly payments through re-amortization.

Re-amortization is when the borrower is able to pay a lump sum of money towards the loan, and your monthly payments are re-calculated based on your remaining balance. This lump sum will reduce your repayment amounts, but will have no impact on the length of the loan.

Here's how it works:

You take out a loan covering the full system cost.

When you file your taxes, you apply for the solar tax credit (worth 30% of system costs).

You receive the credit from the IRS (either as a refund, or in the form of reduced tax liability).

You use the credit to pay off part of the loan, reducing future repayment amounts.

The Power Loan is offered in loan amounts ranging between $15,000 and $65,000, with the following loan terms being offered.

Annual percentage rate (APR)* | Loan term |

|---|---|

1.99% | 12 years |

2.99% | 12 years |

3.99% | 12 years |

4.99% | 20 years |

5.99% | 20 years |

*Enerbank's advertized rates as of May 2022

5. Triple Option Loan

Enerbank’s Triple Option Loan has an extended term, a no-payment period and multiple re-amortizations.

The Triple Option Loan has a no-payment period for 12 to 18 months with re-amortizations occurring on three separate occasions. The first re-amortization occurs after the no-payment period has finished, with the others occurring in May in each of the following two years.

By having multiple re-amortizations, this loan allows you to utilize future cash receipts, as well as federal or local rebates, to pay down your loan. It also provides flexibility to homeowners and borrowers, allowing them to pay down the principal and reduce their monthly payments.

Enerbank’s Triple Option Loan is available in the following different terms and interest rates.

Annual percentage rate (APR)* | Loan term |

|---|---|

4.99% | 12 years |

4.99% | 15 years |

5.99% | 15 years |

4.99% | 20 years |

*Enerbank's advertized rates as of May 2022

Application process

Enerbank’s application process is one of the fastest and most efficient in the industry, and is facilitated through their website and online portal.

Through Enerbank’s online application, you’re able to select your preferred solar loan and then be taken to the loan’s specific application form.

Each loan application form may then require slightly different details to determine your eligibility. Once your eligibility is confirmed and your loan is approved, you're well on your way to having solar panels on your home.

Main concerns from Enerbank reviews

In most cases, Enerbank customers are satisfied with their interactions with the company and its products. This is evident with Enerbank having an A+ company rating with the Better Business Bureau.

However, after scouring over 250 of Enerbank’s reviews, there are certain aspects of Enerbank which seem to be a recurring issue, and a hassle for customers. These negative complaints seem to be targeted around Enerbank’s lack of online payment options, balance visibility and poor customer support.

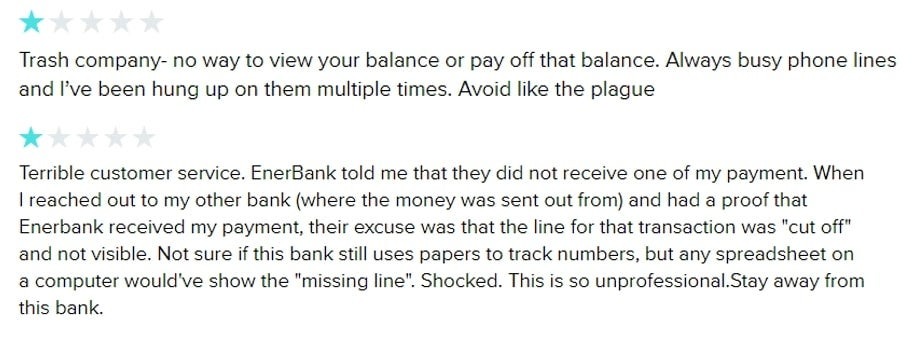

Here are a couple of examples of negative reviews found on Wallet Hub:

As we found similar reviews on a number of different websites, it is clear that there are particular aspects of Enerbank’s procedures and system that they will need to improve.

How does an Enerbank loan compare to other solar loans?

As you may have already found out, there are many different options for financing your solar installation, and finding the best option for you can be difficult.

When comparing an Enerbank loan to other solar loan programs, there are a few aspects that do create a point of difference. These include the zero-interest period attached to select loan options, and Enerbank’s fast approval process.

With the zero-interest period that Enerbank offers with loans such as the Same-As-Cash and Combo Loan, borrowers are able to utilize any rebates and incentives on offer, without paying any interest.

Unlike some solar loans which can take weeks to be approved, an Enerbank solar loan can be applied for and approved on the same day. With their fast eligibility checks and approvals, you’re able to finance your solar system in no time.

Should you go solar with Enerbank?

While most people are quite satisfied with Enerbank as a low-interest home improvement lender, others complain about lack of transparency into their outstanding loan balances.

If you aren’t good with paperwork, don’t manage money proactively, or don’t like the prospect of having to make regular phone calls to an Enerbank customer service representative, then a long term Enerbank loan may not be your best option for home improvement financing.

Their online portal also leaves something to be desired, and their customer relations might be lacking.

Given these concerns, we’re hesitant to enthusiastically recommend one of their longer-term home improvement loans, such as the Triple Option solar loan.

However, if your term length is relatively short and you are confident you can repay the balance in full before the loan expires, then definitely consider one of their zero-interest rate options. After all, the chance to use free money to complete your home improvement project is hard to pass up.

If Enerbank USA isn’t for you, then there are many other solar financing companies that you could consider instead. If you want to learn more about your financing options, check out our expert review of the top 6 solar financing companies.

You can also go to our home solar calculator to find out whether solar financing is right for you.

Cameron is a business analyst and content specialist at SolarReviews. He has a strong passion for sustainable energy and ensuring that American families are informed on the environmental and financial benefits of solar energy....

Learn more about Cameron Bates