Updated 3 days ago

Solar Power Purchase Agreements (PPAs): Pros, Cons, & Red Flags

Written by Catherine Lane Catherine LaneCatherine has been researching and reporting on the solar industry for five years and is the Written Content Manager at SolarReviews. She leads a dyna...Learn more

Use this calculator to find out how much you can save on your electricity bill with solar

Why you can trust SolarReviews

SolarReviews is the leading American website for solar panel reviews and solar panel installation companies. Our industry experts have a combined three decades of solar experience and maintain editorial independence for their reviews. No company can pay to alter the reviews or review scores shown on our site. Learn more about SolarReviews and how we make money.

Solar power purchase agreements, often called PPAs, are a solar financing option that allows you to get solar panels that will reduce your electricity bills installed on your roof for $0 upfront in exchange for monthly payments.

That almost sounds too good to be true — there has to be a catch, right? Well, sort of. Power purchase agreements can be a great way for some people to enjoy the benefits of solar, but because you don’t own the solar panels in these agreements, they can come with significant drawbacks.

Our solar experts put together a comprehensive guide to help you understand everything you need to know about solar PPAs, their pros and cons, red flags to look out for so you don’t get stuck in a bad contract, and if a PPA is the right way for you to pay for solar.

Key takeaways

A solar power purchase agreement (PPA) is a way to finance solar panels in which a solar company installs and owns the solar panels on your roof, but you get to use the solar energy they produce to reduce your electric bills in exchange for a monthly payment.

Solar PPA payments are based on the amount of solar energy a solar system produces and can save between 10% and 30% on electricity costs on average.

With a solar PPA, homeowners do not get to use the federal solar tax credit or other solar incentives and rebates.

If you can’t go solar with cash, we recommend using a solar loan to pay for your solar panels.

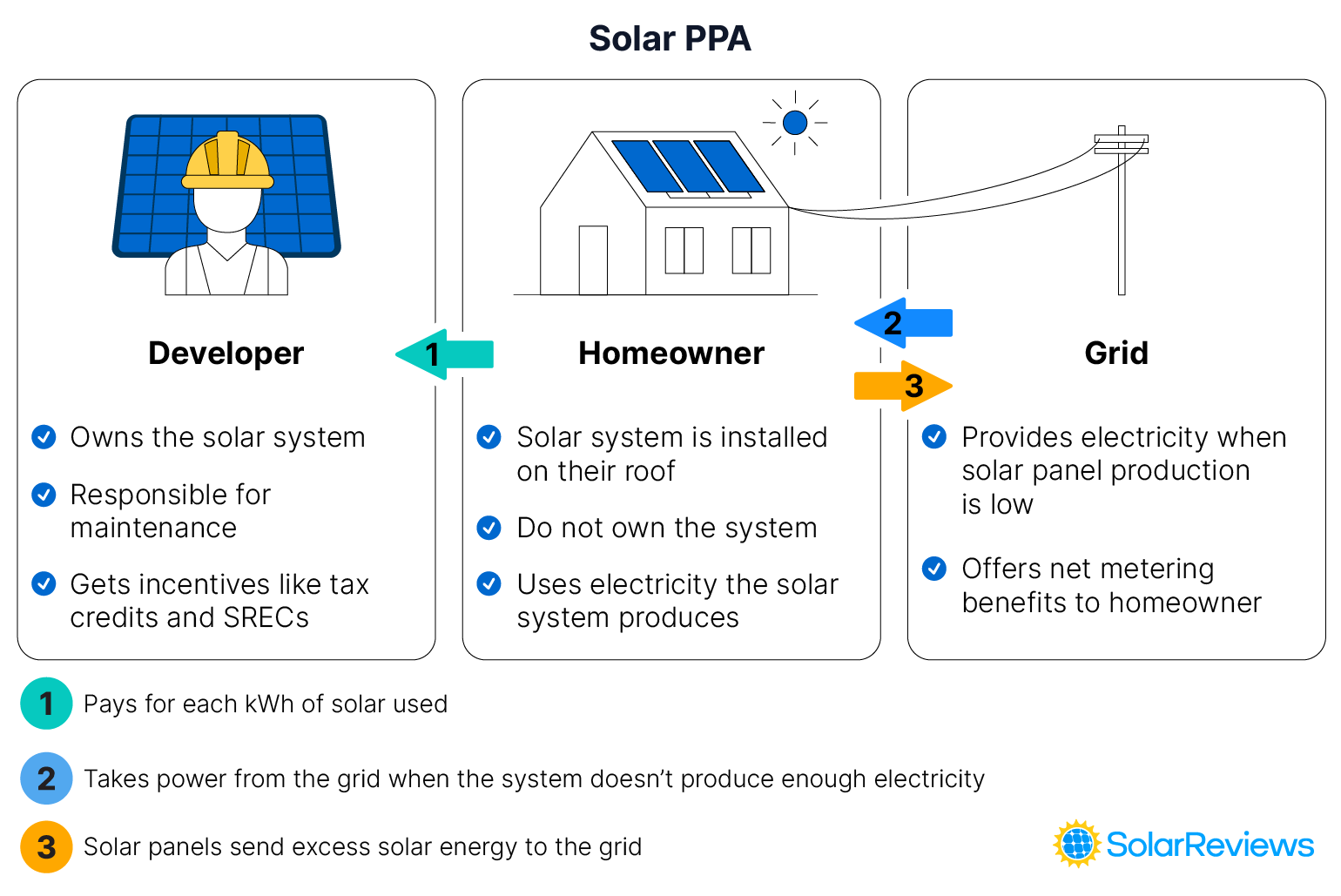

How does a solar PPA work?

A homeowner, also referred to as the host customer, can enter a PPA with a solar installer with terms that range anywhere from five to 25 years.

The solar developer will install the panels on the host customer’s roof, which will generate electricity to power the home and reduce the host’s electricity bills.

With a solar PPA, the solar developer owns the solar panels, not the homeowner. So, the homeowner has to pay the developer for using the solar panels. Monthly PPA payments are based on the amount of solar energy the solar installation produces and the PPA rate outlined in the financing agreement. The PPA rate will usually be designed to be lower than the rate of electricity in your area, which allows you to save on your monthly energy costs.

Payments

Solar PPAs require monthly payments to the company that owns the solar energy system on your roof. These payments are calculated using the solar panels’ energy production in a month and the solar PPA rate per kilowatt-hour (kWh) defined in your contract.

Solar PPA rates will likely be lower than your current electricity rate. So, if your utility company charges $0.17 per kWh, your PPA rate could be $0.14 per kWh. A typical solar lease payment will be between $100 and $130 monthly, but it ultimately depends on the system installed and electricity rates in your area.

Solar PPA payments usually increase throughout the contract. Increases are outlined by the escalator clause in your agreement, and will tell you the rate at which your payments will increase. We recommend steering clear of escalator clauses with rates above 3%, as your PPA rate could end up outpacing electric rate increases in your area, meaning you’ll be paying more for solar than utility power.

It’s important to keep in mind that while solar PPAs reduce your electricity costs, you can still get a utility bill. There may be certain charges that can’t be covered by solar, or you may use more electricity than your solar panels produce, causing you to pay two bills.

Solar PPA savings

Solar PPAs save 10% to 30% on average on monthly electricity costs. For an average home, that’s between $15 and $45 in savings each month. Exactly how much you save will depend on the solar panel system, your home’s energy usage, and the electric rates in your area.

Solar PPAs save money like all solar panel installations do: the solar panels send energy to your home so you use less power from the utility company, reducing your electric bill. If the panels produce excess energy, you get to take advantage of your utility’s net metering policy, where the company gives you energy credits for extra solar power that can further lower your bills.

A salesperson might tell you that the solar panels will completely wipe out your utility bills – and they might! But, you’re still on the hook for the monthly PPA payment, which reduces how much the solar panels save you.

Incentives

When it comes to solar incentives and PPAs, the only one that you get the direct benefit from is net metering. Other incentives like the federal solar tax credit, SRECs, or local rebates usually go to the solar company since they own the system. In other words, you don’t get to claim the solar incentives or tax benefits with a solar PPA.

However, there may be some exceptions to this, depending on the rules surrounding your local incentives. Make sure to ask the installer what incentives you might have access to before you sign a contract.

Maintenance and repairs

While you don't get to use incentives and rebates, there are some perks to the solar company owning the solar panels. If something goes wrong with the system, it’s on the company to fix it. Solar equipment generally needs little maintenance, and solar repairs are somewhat rare. But if issues do arise, it’s the solar company’s responsibility.

While this does mean you avoid having to pay for solar maintenance and repairs, it also means you’re at the mercy of the solar company. If they don’t prioritize your solar project, you can get stuck with solar panels that don’t work and pay both a solar PPA payment and an entire electric bill. When you look at reviews of top solar PPA companies on SolarReviews, some of the most common complaints have to do with poor customer service surrounding repairs.

To avoid this, see if the contract has any performance guarantees or specific language around repair timelines.

Pros and cons of solar PPAs

Pros

$0 down payment

Immediate energy bill savings

Utilize clean energy

Not responsible for maintenance or repairs

Increases access to solar

Cons

Not eligible for tax credits or other incentives

Lower long-term savings

No added property value

Difficulty selling your home

Locked into a contract

Escalator clause

Advantages of solar PPAs

$0 down payment: Solar PPAs don’t require any money upfront, making it easier for people to make the switch to solar without the burden of initial costs.

Immediate savings: With a solar PPA, you start saving on your energy bills right away since you don’t pay anything up front.

Utilize clean energy: Solar PPAs let you power your home with clean, renewable energy to increase your home’s sustainability.

Predictable payments: PPA rates are outlined in your contract, providing you with predictable monthly costs, unlike regular utility bills, which can fluctuate widely.

Not responsible for maintenance or repairs: Since you don’t own the solar panels, you’re not responsible for maintenance or repair costs that may come up during a PPA.

Increased access to solar: The upfront cost of solar panels can be unattainable for many homeowners, and qualifying for solar loans can be challenging. Solar PPAs make solar energy more accessible to a wider range of people.

Disadvantages of solar PPAs

Can’t use tax credits or other incentives: As the homeowner, you don’t get to take direct advantage of the solar tax credit or other incentives with a PPA because you don’t own the solar panels. Instead, the solar company gets those benefits.

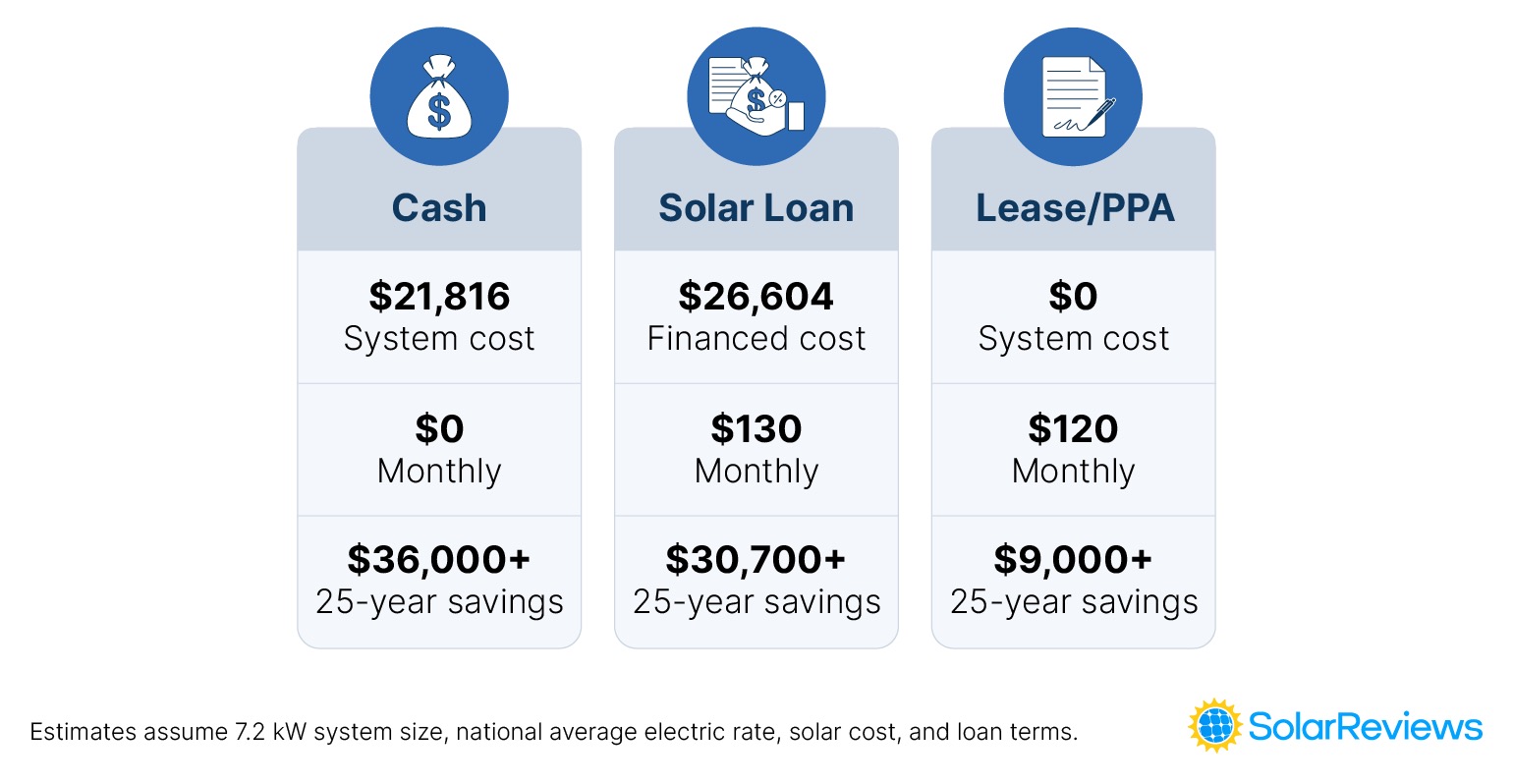

Lower long-term savings: Solar PPAs provide lower long-term solar savings than buying solar panels with cash or a loan because the solar system can never “break even” since you don’t own it.

No added property value: When purchased with cash or a loan, solar panels can increase your home value by an average of 6.8%. Solar PPAs don’t provide the same increase in property value since you don’t own them.

Difficulty selling your home: Selling a home with solar panels and a PPA can be challenging, as many buyers may be hesitant to take over a contract initiated by someone else.

Locked into a contract: With a solar PPA, you’re in a decades-long contract that is difficult and costly to break.

Hard to find point of contact: Some solar installers offer solar PPAs through a separate financing company, so establishing who to contact and who is responsible can be difficult.

Escalator clause: Escalator clauses in solar lease contracts outline how much monthly PPA payments will increase by each year, meaning you’ll be paying more for solar, even though the system is aging.

What happens when my solar PPA contract ends?

There are usually three options for the end of your solar PPA agreement

Sign a new PPA agreement and continue using the solar panels in exchange for monthly payments.

Buy the solar panels from the company and continue using the solar panels without monthly payments.

Have the solar panels removed by the company at the end of the agreement.

Very few homeowners choose to buy the solar panels at the end of the lease, as the cost is typically quite high. Between what you paid in monthly PPA payments and the buyout cost, the total will usually be higher than if you had purchased the solar panels to start with.

4 solar PPA red flags to look out for

Solar salespeople will often highlight the best parts of solar PPAs and will rely on you not knowing the ins and outs of these contracts so you sign them quicker. To avoid falling victim to a solar scam, keep an eye out for these solar PPA red flags:

1. Calling PPAs free solar panels

If a salesperson is promising “free solar panels", remember there’s no such thing as a free lunch. While you may not pay anything upfront for the installation, you’ll still be required to make monthly payments.

2. High escalator clause

It’s common for a solar PPA to include an escalator clause, but you should be cautious if the rate is too high. Otherwise, your PPA payments could outpace your local utility’s electricity rates, meaning you could end up paying more for solar than you would have spent on traditional electricity!

Over the last 25 years, electricity rates have increased by an average of 2.67% annually. This can vary by location. Some states, like Hawaii, have seen an average annual rate increase of 4.58%. Whatever the case for your state, you’ll want your escalator rate to be below that average, or else you run the risk of paying too much for solar.

3. Pushy sales tactics

If a solar salesperson is too pushy, it’s a red flag. Solar is a significant investment, often tens of thousands of dollars, even when leasing. You shouldn’t feel pressured to rush into a decision and risk overlooking important details in the fine print. Hold your ground and don’t sign anything if you don’t feel ready, and maybe consider getting a few more quotes if a company is too aggressive.

4. Low customer review scores

Customer reviews offer valuable insights into how a solar company operates. Before committing to a solar PPA, make sure the company has positive reviews. Since you'll be making monthly payments and relying on them to maintain your system, choosing a company you can trust is crucial.

When reading customer reviews, look at them carefully. Some homeowners might have a great initial experience and provide a five-star rating, while others might come across problems down the road when they need repairs and write a negative review. See what types of reviews are being written and why before you choose a company.

Solar PPA alternatives: Other ways to pay for solar

Yes, there are other solar financing options besides PPAs to help with solar installation costs. Aside from paying for solar energy systems with a solar PPA, you can enter a solar lease or take out a solar loan if paying cash isn’t an option.

Let’s see how solar leasing stacks up against other popular financing options:

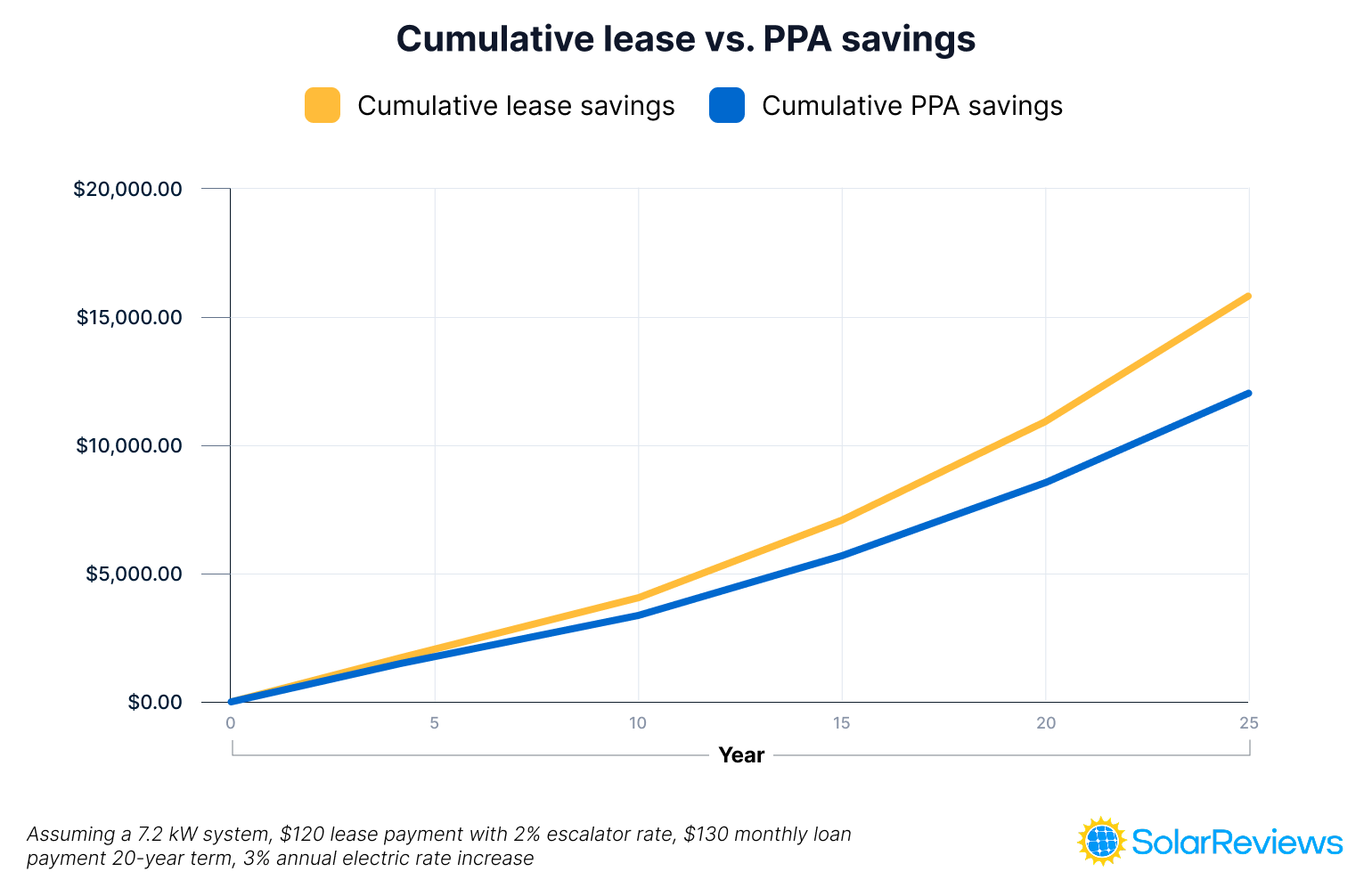

Solar PPA vs solar leases

Solar PPAs are very similar to solar leases. With both options, a solar developer installs, owns, and maintains the solar panels on your roof.

The main difference lies in how you pay for the solar energy. Solar PPA payments are based on the amount of energy the panels actually produce, while solar lease payments are fixed and remain the same each month.

Lifetime solar savings for solar leases and PPAs are close, but PPAs could save slightly more depending on system production. For example, if your solar panels produce less energy in April, a PPA payment will be lower, while a lease payment remains the same.

Both solar leases and PPAs come with the drawback that you won’t be eligible for tax incentives or incentives like the federal solar investment tax credit or local rebates since you don’t own the system.

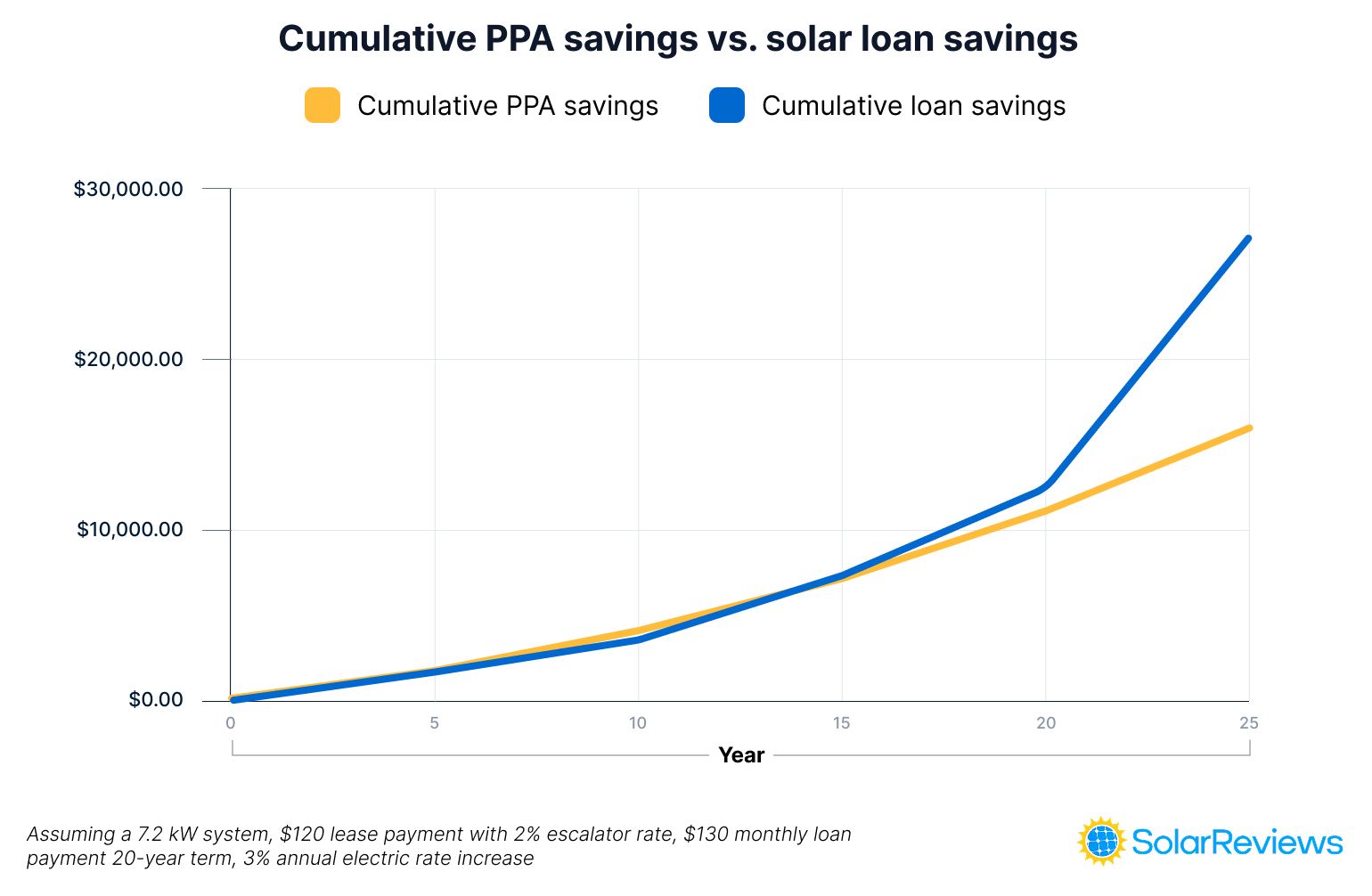

Solar PPA vs solar loans

Solar loans also help with the burden of the upfront investment of solar, but unlike solar PPAs, loans allow you to retain ownership of the solar panels, typically providing better long-term savings. The actual savings will depend on the terms of the loan and the power purchase agreement.

Owning the solar panels means you get to take advantage of all available solar incentives, which can significantly lower the cost of going solar. Using a loan also increases the value of your home, making it an attractive feature for potential buyers if you choose to move.

Once the solar loan is paid off, your panels will provide you with free electricity. Solar PPAs, on the other hand, never reach that break-even point, so you'll never get completely free energy.

Is a solar PPA right for you?

We don’t typically recommend going solar with a power purchase agreement because it provides lower lifetime savings, and the drawbacks can often cause homeowners a headache. If you don’t have the upfront cash to go solar, we suggest looking into solar loans, as you don’t have to worry about having thousands of dollars on hand, and you get all of the benefits of being the owner of the solar panels.

However, this isn’t to say that solar PPAs aren’t all bad. If you don’t have taxable income and can’t take advantage of the 30% federal solar tax credit, a PPA can be a great choice. It’s also an option for people who don’t qualify for loans.

Our advice is to seek out quotes from multiple companies for different financing options so you can find the one that’s right for your budget. This way, you can find the right solar company for you while getting the best value possible.

Looking for more solar financing information?

Check out our guides to different financing types and companies:

Catherine has been researching and reporting on the solar industry for five years and is the Written Content Manager at SolarReviews. She leads a dynamic team in producing informative and engaging content on residential solar to help homeowners make informed decisions about investing in solar panels. Catherine’s expertise has garnered attention from leading industry publications, with her work being featured in Solar Today Magazine and Solar ...

Learn more about Catherine Lane