Updated 1 year ago

What is Levelized Cost of Energy (LCOE), and why should you care?

Written by

Ben Zientara

Find out what solar panels cost in your area

Do you like pizza? Solar energy is kind of like pizza. Wait, stick with us and we’ll explain.

Say you pay $30 a week for pizza (yes, that’s a lot of pizza, but we’re not here to discuss your eating habits). That’s $1,560 for pizza this year. But you love pizza, and you know you’re going to need that much pizza for the long term. With an average cost increase (inflation) of 3.5% per year, you’ll be paying $60,000 for 25 years of pizza.

Now let’s say Electric Boogie’s Pizzeria gave you this deal: You can buy a Permanent Pizza Card for $31,000 today, and we’ll give you as much pizza as you were eating before for the next 25 years. That’s a big check to write, but over the next 25 years, you will have saved $29,000 for the same amount of pizza!

Is it worth it?

The levelized cost of pizza

25 years is a long time, but you know you’re going to want that pizza. You need to find out whether spending $31,000 on the Pizza Card is a better deal than paying for pizza like a commoner. That’s where the LCOP comes in. Given a big investment now, what’s the comparison cost per slice?

If we’re talking about energy and not pizza, some very smart economists figured that out, and LCOE was born.

The pizza card as an investment

You might think a 25-year pizza card sounds like a bad deal. Like, what if you die before the 25 years are up? Well, this Pizza Card has monetary value and can be sold or transferred so another person can use it if you get sick of pizza.

But you’d never get sick of nature’s perfect food, right?

And what if you want to spend $31,000 on something else? That’s a whole different can of pizza sauce, but the way people compare investments is called net present value (NPV), and the NPV of home solar beats the next best alternative (stock market) in 38 states.

Okay, at this point we’re stretching the metaphor a bit, but hopefully, you get the idea.

Let’s bring it back to the Levelized Cost of Energy

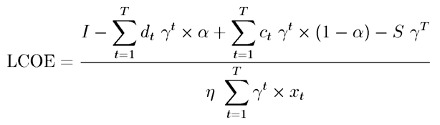

Okay, the pizza metaphor was a bit of a stretch, but we used it because this is the actual formula used to calculate LCOE:

Hold the anchovies

So that’s a thing you know now. That’s it. Thanks for reading! Good luck out there, and enjoy your pizza!

We’re kidding. This formula is important (and yes, people actually use it), so we’re going to make LCOE easier to understand. It’s complicated, but it produces a simple number that can help you see whether solar is right for you.

The definition of LCOE

According to the US Energy Information Administration (EIA), LCOE “represents the average revenue per unit of electricity generated that would be required to cover the costs of building and operating a generating plant during an assumed financial life and duty cycle.”

This includes factors such as:

Upfront costs

Maintenance

Degradation over time

Financing

How many people will actually use it

Tilt angle, shading, and orientation of your roof

And market shifts

For large-scale energy developers, LCOE also acts as an effective way to compare competing sources of energy. They use it to compare solar with wind, coal, and other energy sources.

A definition of LCOE useful to you and me

For everyday folk like you and me, LCOE tells us whether paying for solar now will be cheaper than paying for electricity bills for 25 years, even considering the big upfront investment.

LCOE is represented in cost per kilowatt-hour (kWh) and therefore can be understood around the world and across multiple languages and cultures, kind of like the metric system. Wait, why doesn’t the U.S. use that again?

Are there any criticisms of LCOE?

No one calculation method is perfect, and LCOE is no different. Though widely supported and respected for its accuracy and effectiveness, LCOE has some drawbacks. For example:

It doesn’t take into account the energy source’s effect on society, such as overall environmental impact.

Most calculations don’t consider energy storage and backup costs.

It doesn’t factor the effects of a large-scale system going online or offline. Like starting a car, a system going online uses energy!

It’s not the most important factor for most people considering a residential solar energy system. The upfront costs, direct savings from utility bills, and time required to install are usually at the front of homeowners’ minds.

What is the LCOE metric used for?

Criticisms aside, LCOE is an extremely valuable metric for installers, state solar program managers, public utility commissions, utilities, and energy science nerds everywhere. Perhaps the LCOE’s most practical function is to provide a snapshot of one energy source versus another energy source, in terms of cost and time.

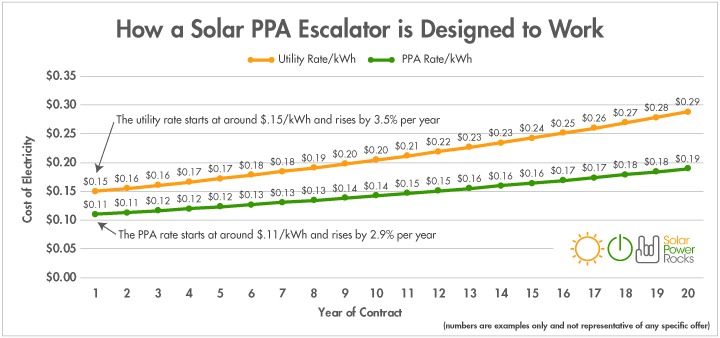

If you go solar with a Power-Purchase Agreement, your solar installer uses LCOE to help determine how much to charge you for every kWh, and how much to increase those charges every year. These increases are called escalator costs.

Escalator costs are set by solar installers and exist to keep up with annual inflation and upkeep. They typically increase from 0 to 3 percent each year, but are designed to keep saving you money.

Your utility company is also constantly analyzing the LCOE of solar versus traditional sources. With the LCOE of solar rivaling (and ultimately surpassing) that of traditional coal, it’s no wonder utility companies are serious about installing large-scale solar systems!

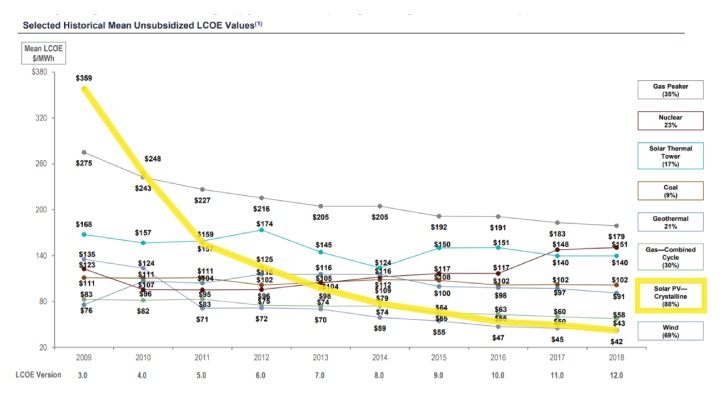

Lazard, one of the world’s leading financial advisory firms, publishes a highly respected LCOE report every year for every major source of energy. This table shows just how quickly the LCOE for solar has decreased over the last decade to become competitive with coal (in megawatt-hours):

Solar energy has by far the most dramatic drop in costs since 2009!

So you’re saying the overall LCOE for home solar compared to my usual utility bill means I’ll save money?

At the end of the day, we’re trying to figure out how much a home solar system will cost, considering all factors, compared to the cost of your existing power bill. Once we do that, we decide if investing in a home solar system is worth it.

If your state’s LCOE for home solar (represented in $/kWh) is less than the price your utility company charges you (also in $/kWh), then going solar is absolutely worth the investment. This simply means that investing in a renewable, climate-friendly source of energy is cheaper in the long run than continuing to give your money to the power company.

And that will only improve: power bills rise an average of 3.5 percent every year, and solar prices decrease every year.

If curiosity has taken over you by now and you really want to see how much you can save by going solar, we can help you get started!

Ben Zientara is a writer, researcher, and solar policy analyst who has written about the residential solar industry, the electric grid, and state utility policy since 2013. His early work included leading the team that produced the annual State Solar Power Rankings Report for the Solar Power Rocks website from 2015 to 2020. The rankings were utilized and referenced by a diverse mix of policymakers, advocacy groups, and media including The Center...

Learn more about Ben Zientara